Money Matters: Notable cost of living adjustments for 2024

Jeff Witz, CFP

Another year of above-average inflation led the Internal Revenue Service to issue meaningful cost-of-living adjustments to Social Security benefits, retirement plan contribution limits, and other items such as gifting and health savings account contributions.

The changes in these areas may require you to adjust how much you contribute to certain accounts and how you approach your budget and tax strategies.

To assist with this, here are the notable cost-of-living adjustments beginning in 2024.

Social Security. Beneficiaries will receive a 3.2% increase in their benefits.

Social Security wage base. The maximum amount of earned income on which employees must pay Social Security taxes was increased from $160,200 in 2023 to $168,600 in 2024.

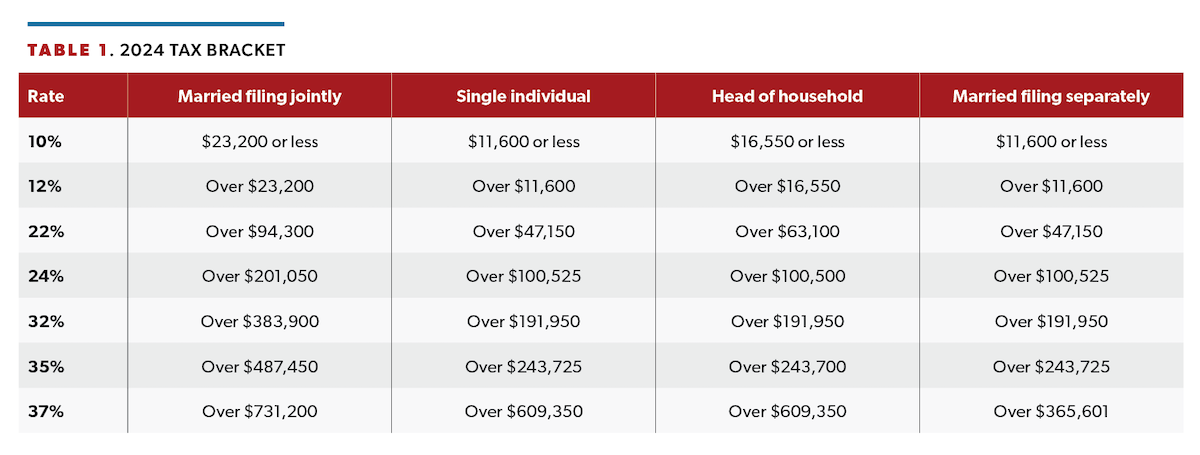

Tax brackets. The tax rates remain the same, but the income brackets were increased (Table 1).

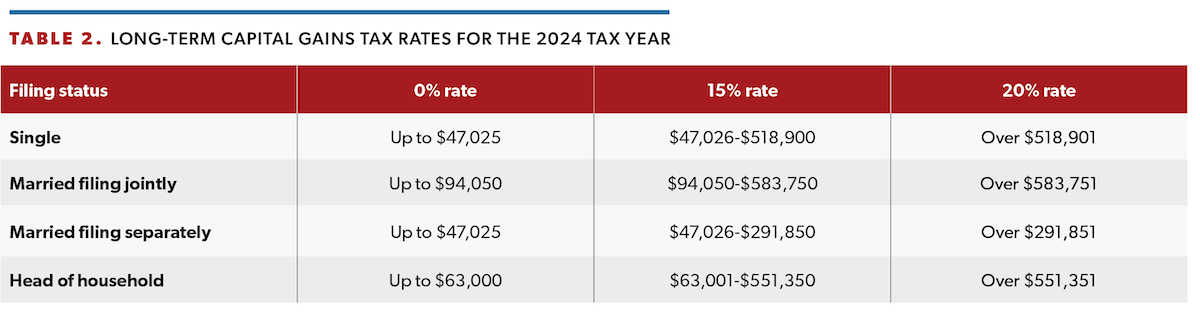

Capital gains rates and income brackets. The capital gains rates remain the same, but the income bracket that determines the rate increased (Table 2).

401(k), 403(b), 457, and thrift savings plan maximum contribution amounts. The maximum amount thatcan be contributed annually to these accounts was increased to $23,000, up from $22,500 in 2023. The “catch-up” contribution amount for employees 50 years and older during 2024 remains the same at $7500, for a total maximum contribution amount of $30,500.

Traditional and Roth individual retirement account (IRA) maximum contribution amounts. The maximum amount that can be contributed annually to these accounts was increased to $7000, up from $6500 in 2023. The catch-up contribution remains $1000, so the maximum contribution amount for those 50 years and older is $8000.

Traditional IRA deduction income limits. For those covered by a workplace retirement plan like a 401(k), the phaseout range for being able to deduct traditional IRA contributions begins at a modified adjusted gross income (MAGI) of $77,000 and ends at $87,000 for single individuals. For married filing jointly, the phaseout range increased to between $123,000 and $143,000. For an IRA contributor not covered by a workplace retirement plan and married to someone who is covered by a workplace retirement plan, the MAGI phaseout range increases to between $230,000 and $240,000. For a married individual filing a separate return who is covered by a workplace retirement plan, the phaseout range remains between $0 and $10,000.

Roth IRA contribution income limits. For individuals who file their taxes as single or head of household, the Roth IRA MAGI phaseout increased to between $146,000 and $161,000. For married couples filing their taxes jointly, the phaseout range begins at $230,000 and ends at $240,000. For married couples filing their taxes separately, the phaseout range remains at between $0 and $10,000.

Savings Incentive Match Plan for Employees (SIMPLE) IRA maximum contribution amount. The amount an employee contributes from their salary to a SIMPLE IRA cannot exceed $16,000 in 2024, up from $15,500 in 2023.

Simplified employee pension (SEP) IRA maximum contribution amount. The maximum SEP IRA contribution amount was increased to $68,000, with maximum countable compensation increased to $345,000.

Health savings account (HSA) contribution amount. The maximum HSA contribution amount was increased to $4150 for a single individual and $8300 for a family on a high-deductible health plan.

Flexible savings account (FSA) contribution amount. The maximum health care FSA contribution amount was increased to $3200. The dependent care FSA contribution amount remains unchanged at $5000. The transportation FSA monthly contribution maximum was increased to $315.

Standard deduction. The 2024 standard deduction for single taxpayers and married filing separately increased $750 to $14,600. For married couples filing jointly, the new standard deduction for 2024 will be $29,200. For taxpayers 65 years or older and married, they can claim an additional standard deduction of $1550 for 2024. This increases to $1950 if you are unmarried or a surviving spouse.

Alternative minimum tax exemptions and phaseout ranges. The exemption amounts for 2024 increased to $85,700 for singles and $133,300 for joint filers. The inflation-adjusted phaseout ranges for 2024 increased to $609,350 to $952,150 for single filers and $1,218,700 to $1,751,900 for married joint filers. Amounts for married couples filing separately are half of those for joint filers.

Gift tax exclusion amount. The annual exclusion for gifts increased from $17,000 in 2023 to $18,000 in 2024.

Estate tax exclusion. The basic estate tax exclusion for inheritances increased from $12,920,000 in 2023 to $13,610,000 in 2024. As a reminder, the higher exemption amount is scheduled to sunset at the end of 2025 and return to lower levels.

As you plan for tax year 2024, we encourage you to speak with your certified public accountant. Beyond typical tax planning, they may offer additional strategies to minimize your tax impact throughout the year.

8750 W. Bryn Mawr Ave. Suite 325 Chicago, Illinois 60631

312-419-3733 - Toll Free 800-883-8555 - Fax 312-332-4908 - www.mediqus.com

Investment advisory services offered through MEDIQUS Asset Advisors, Inc. Securities offered through Ausdal Financial Partners, Inc.Member FINRA/SIPC ∙ 5187 Utica Ridge Rd ∙ Davenport, IA 52807 ∙ 563-326-2064 ∙ MEDIQUS Asset Advisors and Ausdal Financial Partners, Inc. are independently owned and operated.

Effective June 21, 2005, newly issued Internal Revenue Service regulations require that certain types of written advice include a disclaimer. To the extent the preceding message contains written advice relating to a Federal tax issue, the written advice is not intended or written to be used, and it cannot be used by the recipient or any other taxpayer, for the purposes of avoiding Federal tax penalties, and was not written to support the promotion or marketing of the transaction or matters discussed herein.

The information contained in this report is for informational purposes only. Any calculations have been made using techniques we consider reliable but are not guaranteed. Please contact your tax advisor to review this information and to consult with them regarding any questions you may have with respect to this communication.

MEDIQUS Asset Advisors, Inc. does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.